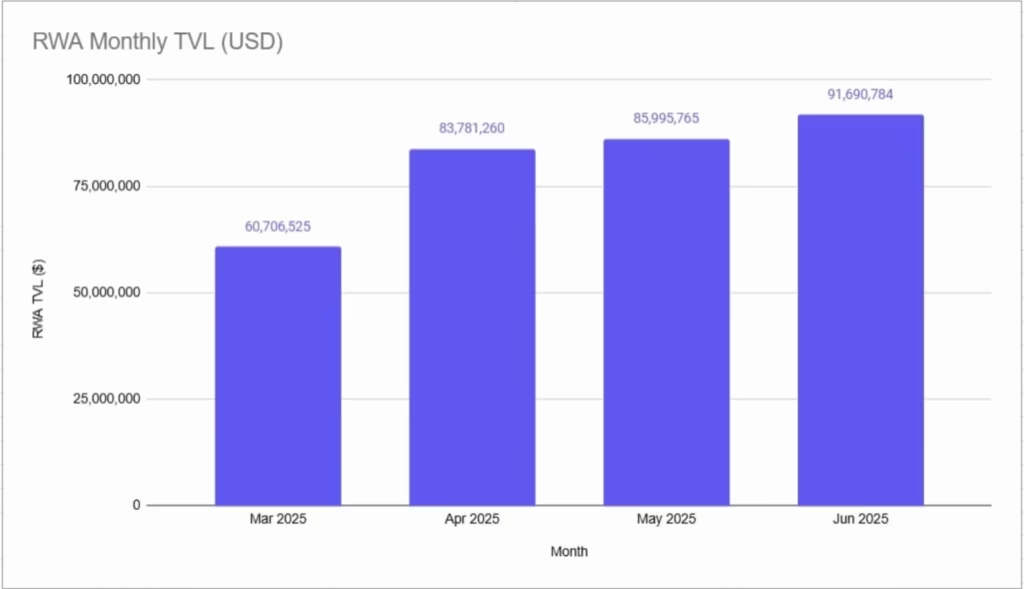

- The demand for Algorand’s chain in the RWA markets has surged by 6.62% to reach $90 million

- This jump is 50% higher than the total on-chain RWA TVL in Q1, i.e., Jan to March 2025.

- In 2025, Algorand has officially positioned itself as an RWA blockchain.

- Real World Asset projects (RWAs) are believed to bring the next major rally in the crypto markets.

In June 2025, there was a 6% surge in Algorand’s RWA TVL which reached $90 million. This TVL is different from the on-chain TVL and represents only tokenized real world assets. The RWA TVL in Q2 (Apr-June) was 50% higher than that at the end of Q1 (Jan-Mar).

Algorand has emerged a major RWA player in the last couple of years due to its scalable and secure blockchain. Its growth was further improved by the Algorand Foundation’s choice to become a RWA-centric blockchain.

RWA Market Growth in 2025

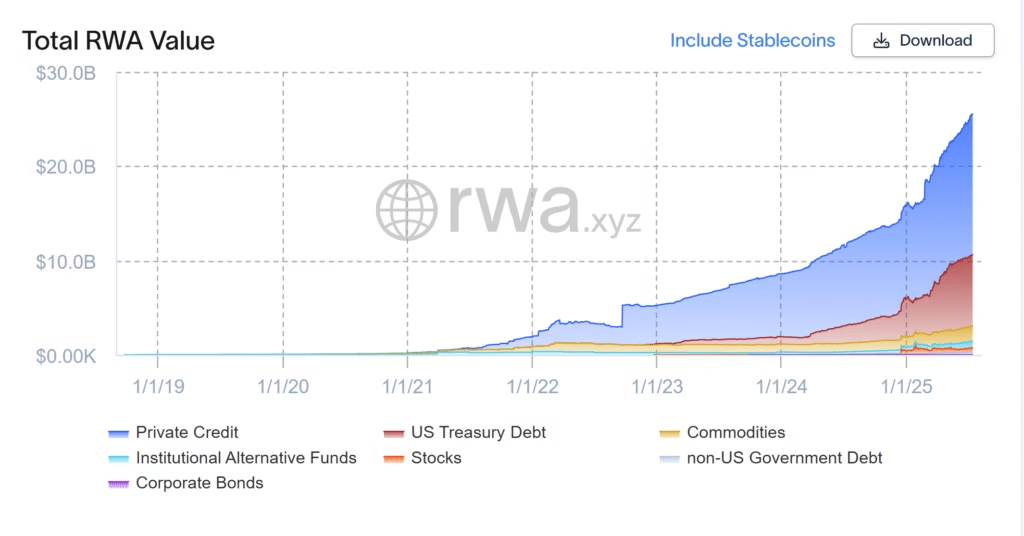

Real World Assets have seen a definite growth in the last one year due to the adoption of this technology by BlackRock, Credit Suisse, Monetary Authority of Singapore, and several other top institutions. The current RWA market size is estimated to be at $25.65 billion excluding stablecoins.

Although stablecoins form the core of current RWA markets, they are not included in this metric because of their limited role in providing only market liquidity.

Since the start of 2025, RWA markets have grown 70% from $15 billion to $25.65 billion at press time.

Algorand as the RWA Blockchain

Algorand as a blockchain might not have specifically targeted the RWA markets. However, the unique characteristics of its blockchain are suitable for RWA applications.

- Ultra low transaction fees.

- Instant finality

- Block time of 2-3 seconds

- No hard forks

- Decentralized validators

- Decentralized governance

- Easy integration in Web3 wallets

Disclaimer: Crypto markets are volatile in nature. All articles in this website are informational and are not financial advice. Please consult your financial adviser before investing.