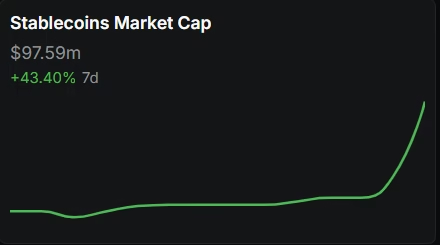

- Between July 5 and 12, Algorand saw an increase of 43.4% increase in its stablecoin volumes.

- The increase was from $66.22 million to $97.59 million.

- Increase in stablecoin also saw a 12.68x increase in the DeFi volumes.

- Technical charts indicate a 50% rally in the next 30 days.

Table of Contents

DeFi Volume Skyrockets by 12.68x

Amid a strong market recovery led by recovery in global macroeconomics. Algorand saw a massive 1268% increase in DeFi volumes from $198k on July 6 to $2.41 million on July 12.

DeFi transactions matter on Algorand because they increase the block utilization and therefore the revenue. A higher revenue helps develop the blockchain in a better way.

Stablecoin Volume Shoots up by 43%

The DeFi volumes were supported by a significant increase in Algorand’s on-chain stablecoin volumes from $66.22 million to $97.59 million.

This growth is critical for Algorand because stablecoins are critical for a blockchains network activity. They are used for payments, providing liquidity,

A Small but Significant Progress

These numbers might seem a very insignificant in comparison to Ethereum or Solana, but the growth in Algorand might sustain in the future due to multiple reasons.

- Algorand is an ultra-cheap blockchain with transaction costs within couple of cents (<$0.02).

- Further, Algo is the only blockchain among major chains that has quantum resistance, a much feared threat to blockchains in general.

- Algorand has much better connections with other projects in the traditional corporate world.

Impact on Algorand’s Price

There hasn’t been any significant change in the price. However, a look at technical charts indicate an upcoming 50% rally in the next 30 days.

Technical charts show that Algo has been stuck in a narrow price range of $0.15 to $0.25 since early March 2025. Though a move below $0.15 is unlikely at this stage, it is likely that Algo will move above $0.25.

Above $0.25, Algo faces a resistance at $0.3. On the downside, $0.15 remains a critical support zone.

Disclaimer: Crypto markets are volatile in nature. All articles in this website are informational and are not financial advice. Please consult your financial adviser before investing.