- Ethereum has not witnessed a similar market rally like Bitcoin due to excessive shorts.

- Most of these shorts are leveraged ones.

- Excessive shorts have pinned down ETH’s price despite its technology being superior to Bitcoin.

- A price sustenance above $2500 till the next expiry could trigger widespread short covering.

- Course of events could be:

- Price remains above $2500

- Options Short Covering

- Futures Short Covering

- Price Rally in Spot Markets

Suggested Reading: Ethereum Price Analysis July 2025

Table of Contents

Excessive Shorts Explain Bearishness in Ethereum

The price of Ethereum has been in a continuous fall since the last two years because of excessive leveraged shorts in it. Despite a rally from $30,000 to $120,000 in Bitcoin in the last nine months, Ethereum made very insignificant progress.

Taking a look at the derivative data it now appears that most of the following Ethereum could be attributed to these short positions. Since most of the short positions are leveraged there is an unbalanced amount of controlling power at the end of leveraged traders.

Sharp Rise in Short Positions

Ethereum saw a sharp rise in its short positions since June 2024. We believe these short positions were caused by the failure of Ethereum Spot ETFs (which failed due to the lack of staking benefits in them).

A year later, in July 2025, Ethereum has witnessed a sharp rise in short positions at 13,291 contracts, the highest number of positions since the last 3 years.

As long as these short positions are present in the market, Ethereum is unlikely to move above $3,500 and even if it does, the move will be unsustainable.

Will This Trigger a Short Covering?

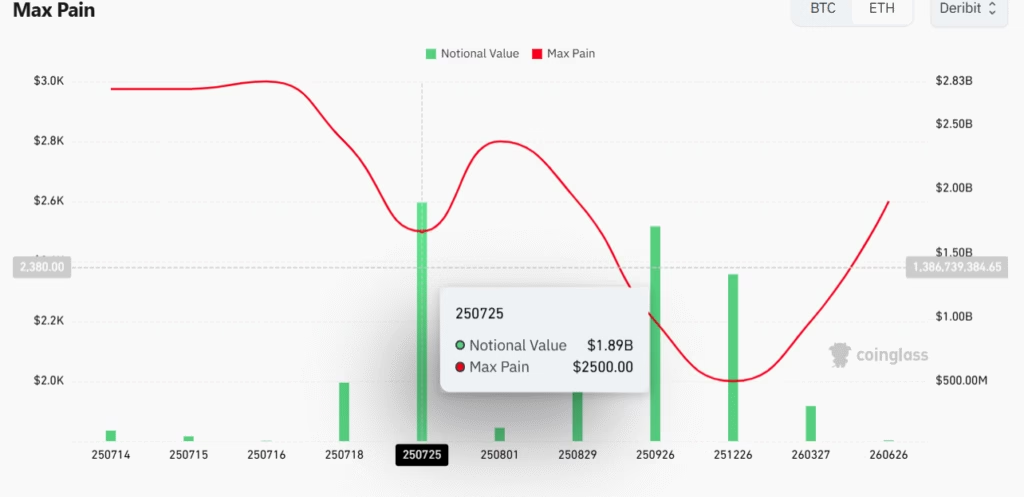

A large number of short positions are likely to trigger a short covering if ETH’s price manages to stay above the current maximum pain point, which, as per options data, is at $2500.

This means that if Ethereum sustains above $2500 till the next expiry, i.e., till July 25, 2025, it would trigger an option market short covering which would then trigger a futures market short covering.

If both of these events take place, we could see Ethereum crossing $4800 in little to no time, most probably by the end of this month.

Despite its volatile price, Ethereum remains a top player in the crypto markets and has been constantly evolving as a leader among blockchains, virtual machines, Layer-1 chains, DeFi applications, and others.

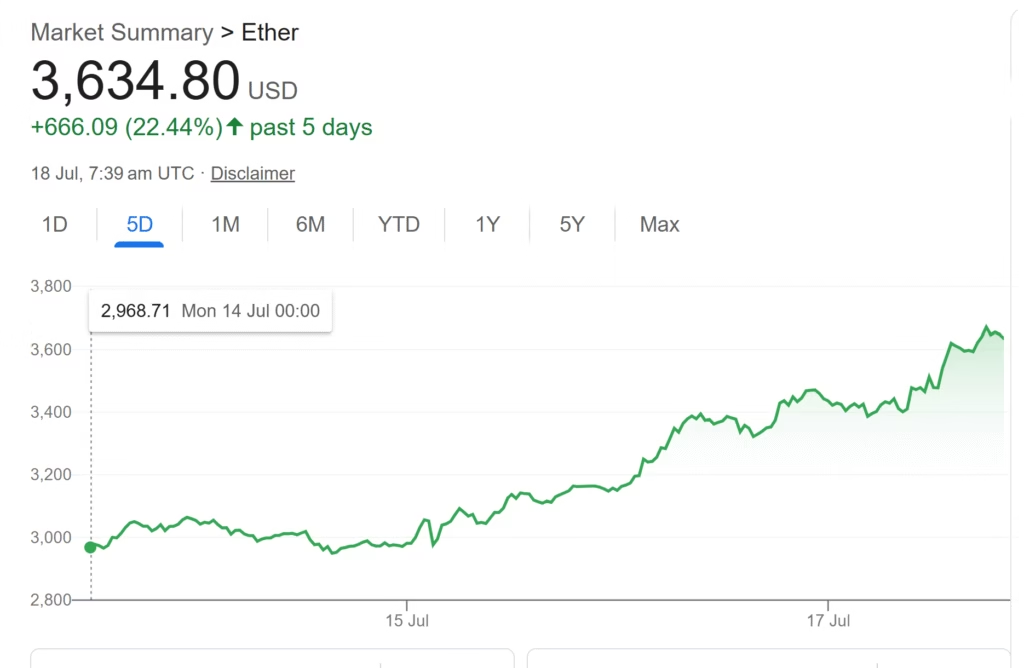

Result (After 4 Days)

Our prediction proved to be accurate, as Ethereum rallied by 20% over approximately 4 days.