Raoul Pal shared this strategy to build a strong crypto portfolio from his X.com account. We previously had interacted with him. Below is a detailed explanation with Raoul.

Table of Contents

1. Don’t Use Leverage

Raoul Pal advises crypto investors against using leverage. This is because leverage wipes out your previous gains with a small mistake. Leverage traders often make mounting losses as a result of unexpected drawdowns. Only a handful of them get success.

To build a long-term portfolio, you need to move out of leverage. Otherwise, there is a very high chance that after a few losses in such trades, you will try to bet your HODL bag (your long-term portfolio) in an attempt to recover your losses.

2. Don’t Give in to FOMO

Fear of Missing Out is the largest influencing factor for people who buy at the top and get trapped (bull trap). Typically, during a bull market top, most people expect the gains to continue without realizing that there is a huge unrealized profit in the market. When this unrealized profit is booked by traders (obviously because everyone wants to make money), the market can correct up to 15%, and in rare cases up to 25%.

Long-term HODLers should stay away from FOMO and buying close to or after bear market bottoms. Obviously, it is not possible to fish out an exact bottom.

3. Top 3 to 5 Assets as Main Bag

When you have fewer assets, say Bitcoin, Ethereum, and Algorand, you tend to even the smallest detail about them. These small details then help you gather information about opportunities, upcoming threats and other news.

Many people, including me, have successfully used this principle to have few assets, so that we can reap the maximum profits out of them.

4. Do Self-Custody or Multi-Sig, With Good Wallet Hygiene

This part is divided into 2 parts, one about using a self-controlled wallet and another about keeping your wallet safe.

4.1. Self-Custody and Multi-Sig

Self-custody is when you take the crypto into a wallet that is controlled by you. It became popular after centralized entities like exchanges were influenced by governments to share user details, and when the FTX exchange went bankrupt.

People usually use hardware wallets, paper wallets, and non-custodial software wallets for self-custody.

4.2. Wallet Hygiene

Wallet Hygiene refers to the practice of keeping one’s wallet keys and recovery phrases in a safe location. This also includes keeping your private keys written somewhere, saved as screenshots, or saved in a message on your PC or phone.

These practices help you secure your portfolio and prevent unauthorized access.

5. Only Trade a Small Degen Bag (Less Than 10%)

A successful portfolio needs to be as little volatile as possible. Degens and memecoins have too high volatility and therefore make wild swings. These swings then impact your net worth and erase the gains you have made on other coins.

However, Degens also have much more potential to go 100x than other altcoins. This makes it necessary to have some exposure to them.

Therefore, limiting your Degen exposure to 10% or say 15% seems to be a wise choice.

6. HODL over a Longer Time Horizon

Investments, however volatile, tend to give good returns over a longer period of time. This strategy has been tested in multiple markets, such as stocks, bonds (i.e., compounding), and even in crypto. For example, early Solana adopters who bought the coin for $15 or less, benefitted with almost a 200% return when Solana touche $294.

7. Zoom Out and Remove the Noise

By Zooming Out, Raoul Pal means to take a pause and analyze what you have bought so far. It is necessary because with time, the value propositions of different projects change. Litecoin, which was once seen as a successor to Bitcoin, has fallen behind others, while XRP, which was once troubled by regulatory cases against it, has become the third-largest crypto.

To zoom out, we suggest spending a day researching each cryptocurrency in your portfolio, catching up on the latest news, criticisms, on-chain metrics, and everything else you can find. Use a2z Cryptocurrencies to stay updated on all the latest research.

8. Expect 35% Pullbacks Frequently

Crypto markets are inherently volatile, which means they can show wild swings in very short periods. For example, Bitcoin went from $30,000 to $120,000 in a little less than a year. Similarly, during the crypto winter, it went from $70,000 to $16,000 in 14 months.

Crypto market investors who are not used to the wild swings in the market often panic and sell their holdings. This panic selling is called FUD.

Raoul Pal said that all investors must expect frequent pullbacks (i.e., price corrections). As the market matures, these pullbacks will be less frequent.

9. Buy the F@cking Dip if You Can

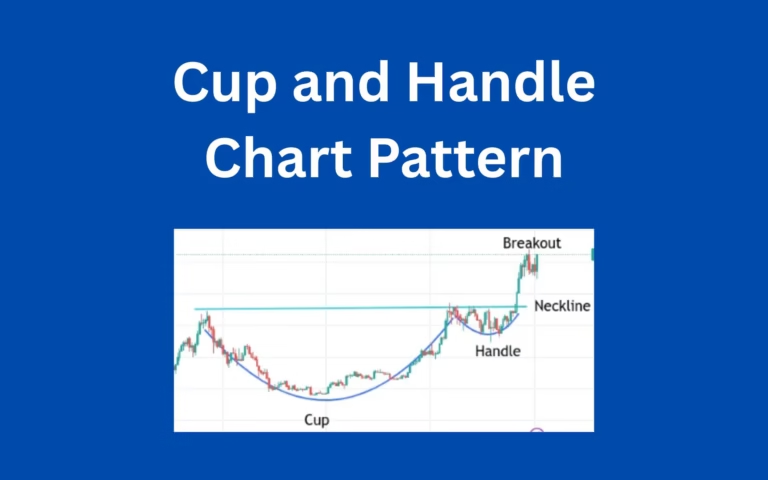

Buying the dip is a method of investing where crypto is bought at each major price correction, say at every 20% fall. The strategy yields significant results when the price recovers.

Who is Raoul Pal?

Raoul Pal is a well-known crypto investor with a portfolio size of $60 million. He is a prominent crypto media personality with over 1.2 million followers on X.com.