- IMF’s latest post endorses stablecoins, calling them “mostly backed” by US Treasuries.

- The same IMF delayed a loan to El Salvador due to its Bitcoin purchase.

- USDT issuer Tether holds $6.5 billion worth of Bitcoin.

- Circle (USDC), PayPal (PYUSD), First Digital (FDUSD), Maker (DAI), and the Trump family (USD1) also hold Bitcoins.

Table of Contents

IMF Endorsing Stablecoins

The IMF report on stablecoin was featured on a post on its X.com handle, highlighting the growing influence of stablecoins. It also highlights the mainstream adoption of stablecoins, which it considers to be secure assets backed by US Treasuries or other cash equivalents, which is reasonable.

The post also highlights the asset composition of two major stablecoins, USDT and USDC, with the former under the crosshairs of transparency watchers. Interestingly, Tether has launched another stablecoin for the US Markets called USAT.

Just last December, the IMF also issued a warning against stablecoins.

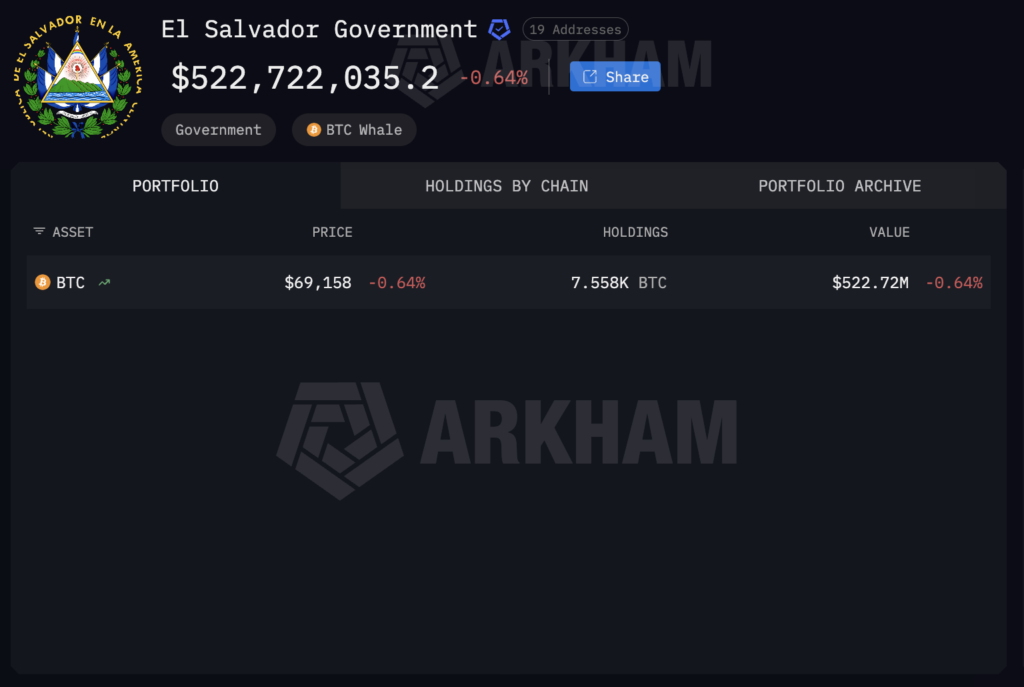

IMF Restricts El Salvador, Argentina from Buying Crypto

The same IMF restricts smaller countries like El Salvador and Argentina from buying Bitcoin or adopting a general policy of accepting cryptocurrencies.

In 2024, the IMF paused El Salvador’s access to a $1.4 billion government financing plan due to the country’s Bitcoin purchases. El Salvador holds the fourth-largest Bitcoin reserves (7,500 BTC) after Venezuela (600,000 BTC), the US (200,000 BTC), and China (200,000 BTC).

All Stablecoin Issuers Hold Large Bitcoin Reserves

Interestingly, all the stablecoin issuers that the IMF endorses, as well as other smaller players, hold a significant amount of Bitcoin in their portfolios. Here are the four largest stablecoins with their Bitcoin holdings.

- Tether (USDT) – 96,184 BTC

- Circle (USDC) – 73 BTC

- Maker (DAI) – 369 WBTC

- Trump Family (USD1) – 9,539 BTC

Disclaimer: Crypto markets are volatile in nature. All articles on A2Z Cryptocurrencies are informational and are not financial advice. Please consult your financial adviser before investing.